Budget is a word often associated with constrained or limited resources. Most people have a budget in their personal life to better plan to pay their bills, save money and spend wisely. It helps people have a goal for saving and building up a nest egg for those unexpected surprises like a broken washing machine. It is a careful and planned balancing act.

For businesses, the premise is much the same; planning where, how much and when the money coming into your business will be invested, spent or saved. Budgeting should go beyond simply being a control and restriction mechanism. It can also be used as a tool to plan the steps to reaching your financial goals, identify areas that can be improved and ensure that your company is saving for an unanticipated event like a global pandemic or a machine breakdown.

Getting Started

(A Practical Guide)

Getting Started (A Practical Guide)

Get started in the budgeting exercise by pulling a 12 month Profit and Loss report from Xero (or your current accounting system) covering the entire prior financial year into Excel or Google Sheets. If you don’t have a full year, pull all completed months and use those as a baseline.

From here, you are able to see the monthly sales and operating expenses of your business throughout the year. Utilising the prior figures as a baseline allows you to have a starting point from which you can adjust based on your goals for the year ahead.

Remember that the past performance is not always a perfect indication of the future. I’m sure we can all agree that the financial performance of 2020 is likely to be vastly different from the plans we are making now so the future should be kept in mind.

Estimating Sales

Using your current figures is a good starting point of where your sales are going. We suggest setting out monthly and yearly sales targets by key service or revenue line and include any projects you know are coming up. An increased sales target is often one of the KPI’s (key performance indicators) of a budget. When reviewing your sales figures, a few key questions that are helpful for you to answer are:

- Do you have capacity within your current team to handle the increase in sales?

- Are the monthly/annual growth rates realistic?

- Do you have sufficient stock to cater for the increased sales?

- Do you need to expand into different locations or channels in order to reach your targets?

- Are there any lead times that you need to consider?

- Do you have the right marketing plan in place?

- Are you subject to any global/environmental changes that could impact your sales?

Estimating Expenses:

When looking at expenses, highlight the essential costs and take an average across the year as a starting point. It is important to group or categorise your expenses into understandable buckets. These buckets or categories will help you understand the areas that you are spending your money on and will help you to better manage your costs. As accountants, we often find that business owners don’t have a good understanding of what goes into each category and so before you dive into forecasting your expenses, have a good look over the last 12 month and dig into any anomalies that you don’t understand. By understanding what makes up the various categories and how they were formed, you’re better able to forecast your spending over the coming 12 months.

Looking at the economy and the general environment you operate in, try to predict things that may increase your costs in the future.

Some great questions to ask yourself are:

- Based on your sales targets, are there any additional hires required?

- Do you require additional warehouse or office space to cater for growth?

- Do you need to buy any new equipment or assets like a company delivery vehicle?

- Will any new assets need to be financed via a loan or a hire purchase arrangement?

- Are there any ad hoc expenses that need to be factored into your budget?

- What taxes are due to during the year and how do they impact on your Profit and Loss?

- Are there plans to pay out any bonuses to your team?

- To reduce the risk of large financial outflows such as replacing stolen goods or damaged machinery, have you got appropriate insurance cover?

- Have you factored in repairs or maintenance due in the current year?

At this stage, it is important to try to think of every expense and any risk of a large unexpected expense occurring. These key questions around your income and expenses should be discussed with the key personnel that form part of your leadership team whilst building your budget.

Monitoring your Budget

Team buy-in is critical to ensuring that your budget targets are achieved. When creating your budget, it is important to identify who will be held accountable for the various categories that make up your budget. These are often broken down into key areas such as Sales, Marketing, Admin, IT, Finance and Operations. For smaller businesses, one person often is assigned multiple areas, but as your business grows, it is important to re-evaluate these assumptions.

Assigning a Budget Owner allows you, as a business owner, to assign responsibility and associate KPIs to each person, thereby incentivising them to achieve their targets.

On a monthly basis, it is important to review your actual figures against the budget and identify the reasons for why your budgeted figures do not align with your actuals. Understanding the variances in your income and expenses, will help you to either adjust your future budgeted figures or help you tighten up on areas that are showing overspend. The regular review of budgeted vs actual figures is critical to ensuring your business stays on track to reaching its goals. It allows you to be nimble in your approach and adjust to changes identified.

Xero and Budgeting

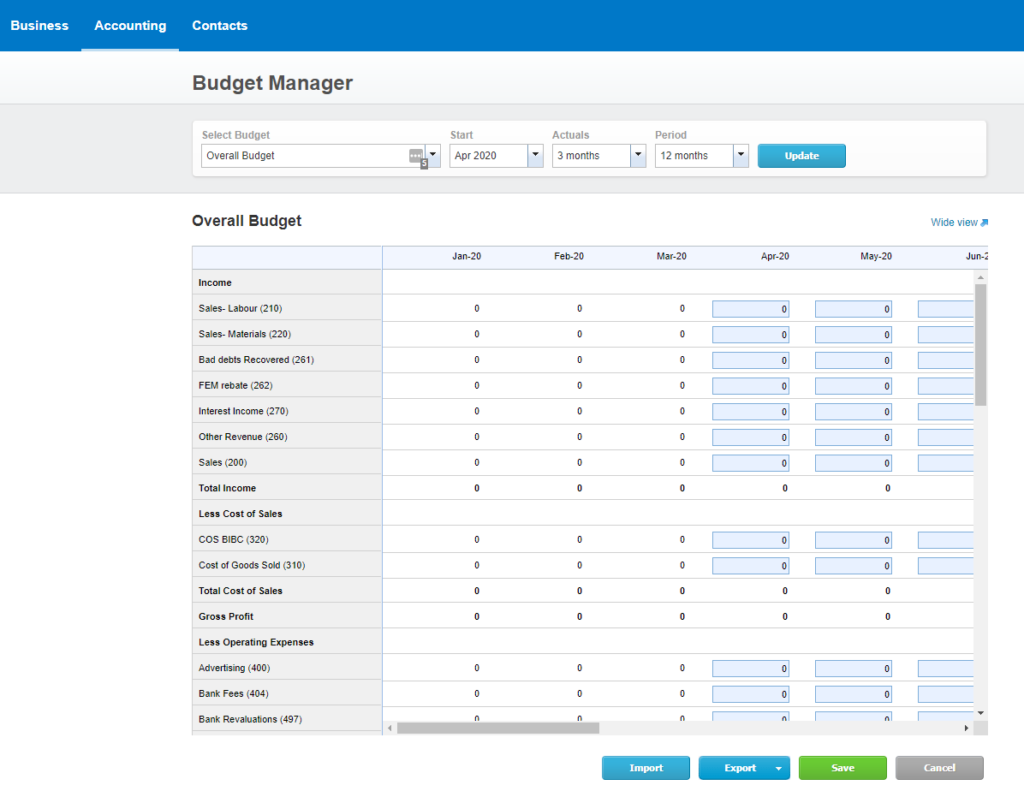

If you are using Xero and would like to track your actual figures against budget, you can easily import budgeted figures into Xero using the Budget Manager feature. You’re able to either manually capture a budget within Xero or simply import a budget using a budget template. Once imported, there are many great ways to use Xero to report on budget variances. We suggest starting with the Budget Variance Report found under Accounting – Reports, but you’re also able to build custom reports through the new Profit and Loss reports within Xero.

Final Thoughts

Having a budget that is tracked means that you have a clear plan for your goals and a way to identify if you are on track. You are also able to quickly identify issues and rein in rogue spenders or errant customers.

A budget has the ability to motivate your team and get all departments on the same page in terms of the overall business goals for the quarter and year ahead. It also incentivises people to push towards their goals in the hopes of receiving that bonus or other incentive.

Monitoring your budget and adapting it for changes that arise is an ongoing process that should form part of management and operational team meetings. A budget can be an empowering management tool and give direction for you and your team in a clear and measurable way when used wisely. Good luck with your budgeting journey ahead and be sure to include your financial partner in your future budgeting discussions.